Understanding Comprehensive vs. Collision Car Insurance in 2025

Navigating the world of auto insurance can be daunting, especially when deciding between comprehensive car insurance and collision car insurance. As we move into 2025, understanding these coverage options is crucial for vehicle owners looking to protect their assets while managing costs. This comprehensive guide breaks down the differences between comprehensive and collision car insurance, explores their benefits, costs, and ideal use cases, and provides actionable insights to help you choose the right vehicle insurance coverage for your needs. Whether you're insuring a new car or reevaluating your existing policy, this article will equip you with the knowledge to make an informed decision in the ever-evolving auto insurance landscape.

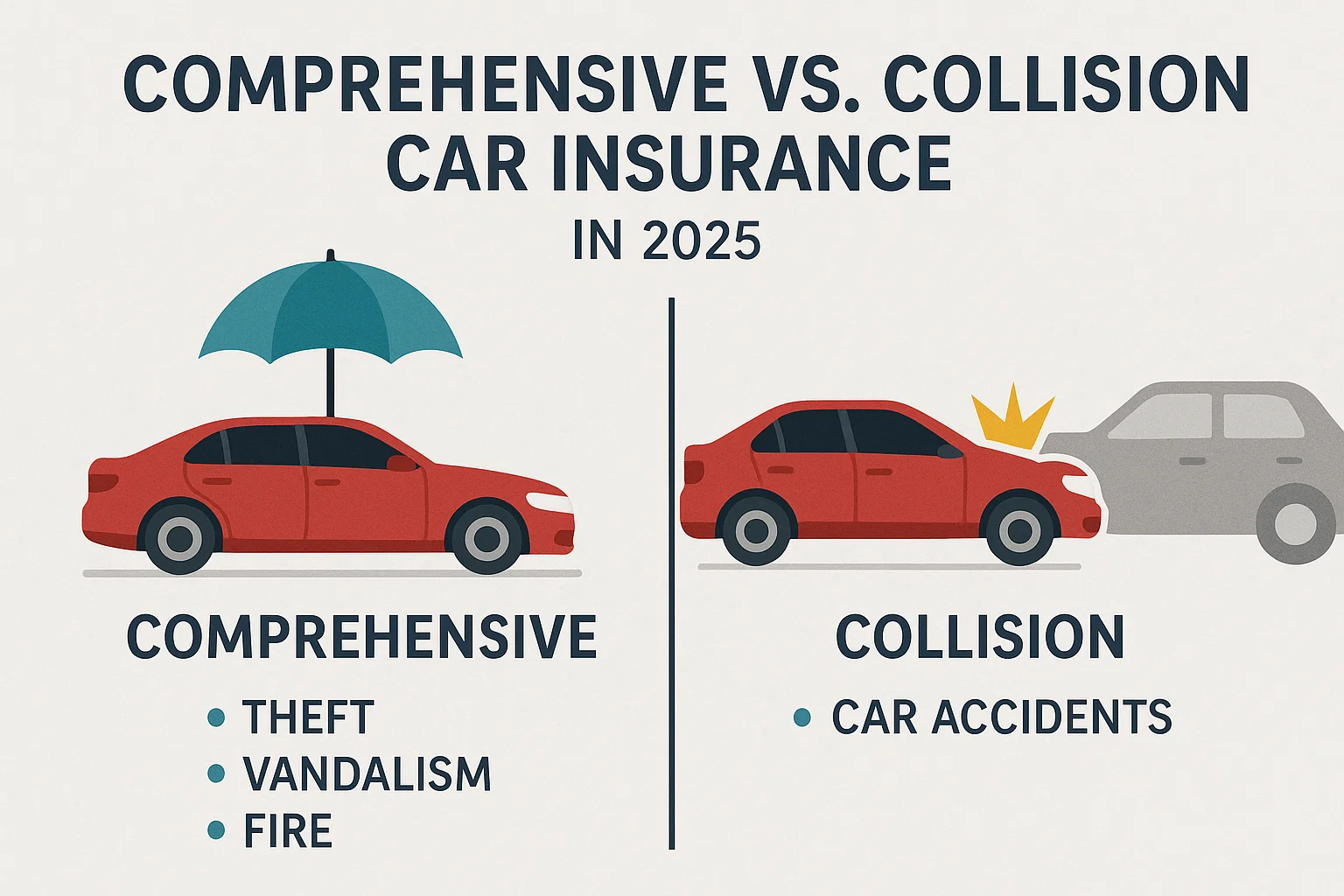

What is Comprehensive Car Insurance?

Comprehensive car insurance is a type of coverage that protects your vehicle from non-collision-related damages. Often referred to as 'other than collision' coverage, it safeguards your car against a wide range of risks, such as theft, vandalism, natural disasters, and animal collisions. In 2025, comprehensive insurance is increasingly popular due to rising incidents of extreme weather and vehicle theft, making it a critical component of a well-rounded auto insurance policy.

Key Coverage Areas:

- Theft: Covers the cost of replacing your vehicle if it’s stolen.

- Vandalism: Pays for repairs due to intentional damage, such as scratched paint or broken windows.

- Natural Disasters: Includes damage from floods, hurricanes, earthquakes, or wildfires.

- Animal Collisions: Covers repairs for damage caused by hitting animals, such as deer.

- Falling Objects: Protects against damage from falling trees, branches, or debris.

- Glass Damage: Covers windshield or window repairs, often with no deductible in some policies.

Why It’s Important: Comprehensive coverage is ideal for protecting your vehicle from unpredictable events beyond your control. For drivers in areas prone to severe weather or high crime rates, this coverage provides peace of mind and financial security.

What is Collision Car Insurance?

Collision car insurance covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. This type of coverage is essential for drivers who want to ensure their car is protected in accidents, whether it’s a minor fender-bender or a major crash.

Key Coverage Areas:

- Vehicle Collisions: Covers repairs for accidents involving another car.

- Object Collisions: Pays for damage caused by hitting objects like poles, fences, or trees.

- Rollover Accidents: Covers repairs if your vehicle flips or rolls over.

- Single-Car Accidents: Protects against damage from accidents where no other vehicle is involved.

Why It’s Important: Collision coverage is critical for drivers who frequently travel in high-traffic areas or own high-value vehicles. It ensures that repair costs are covered, even if you’re at fault or the other driver is uninsured.

Comprehensive vs. Collision Car Insurance: Key Differences

Understanding the distinctions between comprehensive and collision car insurance is essential for selecting the right coverage. Here’s a detailed comparison to clarify their differences:

| Aspect | Comprehensive Insurance | Collision Insurance |

|---|---|---|

| Coverage Type | Non-collision incidents (theft, vandalism, weather) | Collision-related incidents (accidents, rollovers) |

| Typical Scenarios | Flood damage, stolen vehicle, deer collision | Car accidents, hitting a pole, rollovers |

| Cost | Generally cheaper, with lower premiums | Higher premiums due to frequent claims |

| Deductible | Lower deductibles, often $100-$500 | Higher deductibles, typically $500-$1,000 |

| Mandatory | Optional, unless required by a lender | Optional, but often required for financed vehicles |

Key Takeaway: Comprehensive insurance covers non-collision events, while collision insurance focuses on accident-related damage. Both are optional but may be required by lenders for financed or leased vehicles.

Cost of Comprehensive and Collision Car Insurance in 2025

The cost of auto insurance varies based on factors like your vehicle’s value, driving history, location, and coverage limits. In 2025, premiums for comprehensive and collision insurance are influenced by rising repair costs, advanced vehicle technologies, and regional risk factors.

Average Costs:

- Comprehensive Insurance: $150-$300 per year, depending on the vehicle’s value and location.

- Collision Insurance: $300-$600 per year, reflecting higher claim frequency.

- Combined Coverage: $450-$900 per year for both, with discounts for bundling.

Factors Affecting Costs:

- Vehicle Type: Luxury or high-value cars have higher premiums due to costly repairs.

- Location: Urban areas with high traffic or crime rates increase premiums.

- Driving Record: Clean records result in lower rates.

- Deductibles: Higher deductibles lower premiums but increase out-of-pocket costs.

- Discounts: Bundling, safe driver discounts, and telematics programs can reduce costs.

Tip: Compare quotes from multiple insurers to find affordable auto insurance that balances coverage and cost. Online comparison tools in 2025 make this process quick and efficient.

Benefits of Comprehensive and Collision Insurance

Both types of coverage offer significant advantages for vehicle owners in 2025:

Benefits of Comprehensive Insurance

- Protection Against Unpredictable Events: Covers damage from natural disasters, theft, and vandalism.

- Lower Premiums: Generally more affordable than collision coverage.

- Peace of Mind: Ideal for drivers in high-risk areas for weather or crime.

- Glass Coverage: Many policies offer zero-deductible windshield repairs.

Benefits of Collision Insurance

- Accident Protection: Covers repairs regardless of fault, ensuring financial security.

- High-Value Vehicle Protection: Essential for expensive cars with high repair costs.

- Lender Compliance: Meets requirements for financed or leased vehicles.

- Comprehensive Accident Coverage: Includes single-car accidents and rollovers.

Why Combine Both? Combining comprehensive and collision insurance provides full-spectrum protection, covering both accident-related and non-collision damages. This is particularly valuable for newer or high-value vehicles.

When to Choose Comprehensive vs. Collision Insurance

Deciding whether to opt for comprehensive, collision, or both depends on your circumstances:

When to Choose Comprehensive Insurance

- You live in an area prone to natural disasters (e.g., floods, hurricanes).

- Your vehicle is parked in high-crime areas with risks of theft or vandalism.

- You own a moderately valued car and want affordable protection.

- Your lender requires comprehensive coverage for a financed vehicle.

When to Choose Collision Insurance

- You drive in high-traffic areas with a higher risk of accidents.

- You own a high-value or new vehicle with expensive repair costs.

- Your lender requires collision coverage for a financed or leased car.

- You want protection for accidents regardless of fault.

When to Choose Both

- You own a new or expensive vehicle that requires full protection.

- You drive frequently and face risks of both accidents and non-collision events.

- Your lender mandates both coverages for a financed vehicle.

- You want maximum peace of mind and financial security.

Pro Tip: If your vehicle is older and fully paid off, consider dropping collision or comprehensive coverage to save on premiums, especially if repair costs exceed the car’s value.

Top Auto Insurance Providers for Comprehensive and Collision Coverage in 2025

In 2025, several insurance providers stand out for offering robust comprehensive and collision coverage. Here’s a look at some top options:

1. Geico

Geico is known for its affordable rates and user-friendly online tools. It offers competitive comprehensive and collision coverage with flexible deductibles.

Key Features:

- Low premiums for comprehensive coverage.

- Easy online claims process.

- Discounts for safe drivers and multi-policy bundling.

Why It’s Great: Geico’s affordability and digital-first approach make it ideal for budget-conscious drivers seeking comprehensive and collision coverage.

2. Progressive

Progressive offers customizable auto insurance policies with strong comprehensive and collision options. Its Snapshot telematics program rewards safe driving with discounts.

Key Features:

- Flexible deductibles for comprehensive and collision coverage.

- Telematics-based discounts for safe drivers.

- Comprehensive claims support for natural disasters and theft.

Why It’s Great: Progressive’s telematics and customization options make it a top choice for tech-savvy drivers.

3. State Farm

State Farm is a trusted name in vehicle insurance, offering comprehensive and collision coverage with excellent customer service.

Key Features:

- Robust comprehensive coverage for weather-related damages.

- 24/7 claims support and local agents.

- Discounts for bundling and safe driving.

Why It’s Great: State Farm’s reliable service and nationwide network make it ideal for drivers seeking personalized support.

4. Allstate

Allstate provides comprehensive and collision coverage with added benefits like accident forgiveness and new car replacement.

Key Features:

- Accident forgiveness to prevent premium increases.

- New car replacement for totaled vehicles.

- Customizable comprehensive and collision plans.

Why It’s Great: Allstate’s additional perks make it a great choice for drivers with new or high-value vehicles.

How to Save on Comprehensive and Collision Insurance

In 2025, rising auto insurance costs make it essential to find ways to save. Here are some strategies:

- Increase Deductibles: Opt for higher deductibles to lower premiums, if you can afford out-of-pocket costs.

- Bundle Policies: Combine auto, home, or renters insurance for multi-policy discounts.

- Use Telematics: Enroll in programs like Progressive’s Snapshot to earn safe driving discounts.

- Compare Quotes: Shop around using online comparison tools to find the best rates.

- Maintain a Clean Record: Avoid accidents and tickets to keep premiums low.

- Choose a Safe Vehicle: Cars with advanced safety features often qualify for lower rates.

By implementing these strategies, you can secure affordable auto insurance without compromising coverage.

Challenges of Choosing Comprehensive and Collision Insurance

Selecting the right coverage comes with challenges:

- Cost Concerns: High premiums for collision coverage can strain budgets. Compare providers to find affordable options.

- Understanding Coverage: Complex policy terms can be confusing. Work with an agent or use online resources to clarify options.

- Vehicle Value: Older cars may not justify comprehensive or collision coverage. Assess your car’s value before purchasing.

- Lender Requirements: Financed vehicles often require both coverages, limiting flexibility. Negotiate deductibles to manage costs.

Addressing these challenges proactively ensures you choose the right coverage for your needs.

Conclusion

In 2025, understanding the differences between comprehensive and collision car insurance is essential for protecting your vehicle and managing costs. Comprehensive coverage safeguards against non-collision events like theft and natural disasters, while collision coverage protects against accident-related damage. By evaluating your driving habits, vehicle value, and budget, you can choose the right combination of coverage to suit your needs. Top providers like Geico, Progressive, State Farm, and Allstate offer robust options for vehicle insurance coverage in 2025. Compare quotes, explore discounts, and consult with insurance professionals to find affordable auto insurance that provides peace of mind and financial security.

Ready to find the perfect auto insurance policy? Start comparing comprehensive and collision coverage options today to protect your vehicle in 2025. Subscribe to our newsletter for more tips on navigating the car insurance landscape and saving on premiums.

Comments (3)